The Federal Reserve Bank of New York (NY Fed) released the August results of their Empire State Manufacturing Survey last week. Media outlets like the Albany Times Union have highlighted some of the more dour aspects of the report. This kind of reporting is important in providing a finger on the pulse of one of our state’s most important sectors. When it comes to workforce, there is almost always more to the story.

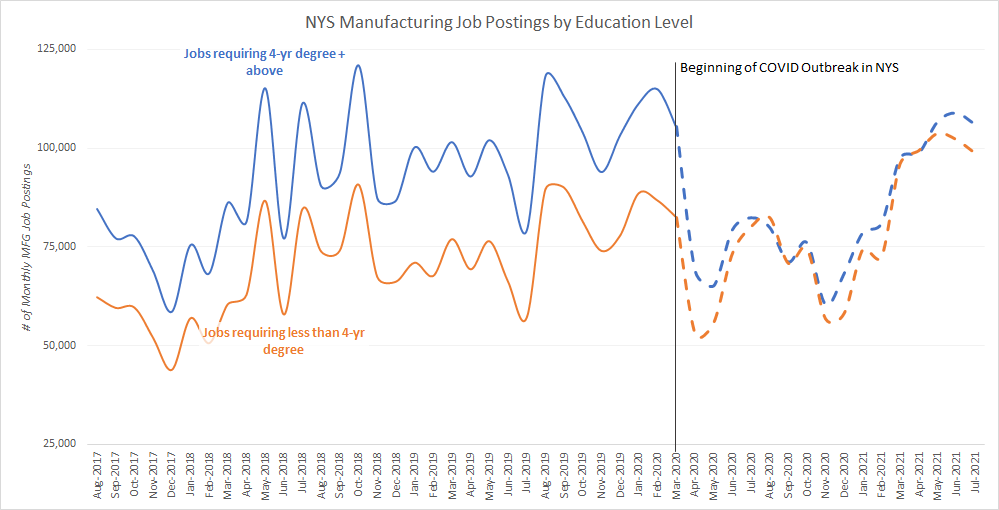

We took the NY Fed’s August survey release as an opportunity to look into some job posting data for New York’s manufacturing sector. What we found suggests that the sector’s recruiting, as reflected in online job postings, has largely recovered to 2018/2019 levels, but who is being recruited is undergoing some change. In August 2020 and April 2021, monthly job postings for manufacturing jobs requiring less than a four-year degree exceeded jobs requiring at least a four-year degree for the first time since Burning Glass Technologies began tracking such data.

The climb in job postings since November 2020 is encouraging. Between November 2020 and June 2021, job postings increased by an average of almost 7,000 per month for jobs requiring a four-year degree or more, reaching over 108,000 in June. This trend stopped in July when there were roughly 2,700 fewer postings than the previous month. July 2021 posting levels monthly postings were roughly 2,700.

Since a drop from March to April 2020 of nearly 30,000 postings, jobs requiring less than a four-year degree have also climbed back, averaging an increase of over 3,500 postings month to month through June 2021. These jobs also saw a drop from June to July but total postings were still well above the monthly averages for 2018 and 2019. This will comfort those looking for optimistic hiring news. There are lots of openings statewide in manufacturing. It is too uncertain to predict how hiring will continue in the coming months.

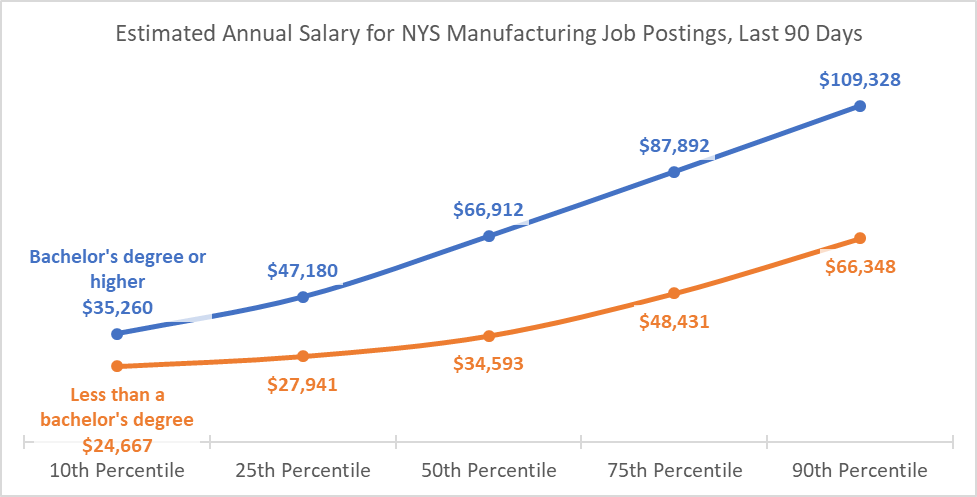

So, what do these jobs pay? It’s difficult to say since fewer than 3 in 10 of these job postings included specific salary information. Recognizing that missing or unclear salary information is a persistent and widespread challenge for workforce developers and labor market data analysts, Burning Glass Technologies developed a “Market Salary” tool for their clients. Market Salary uses multiple data sources to estimate what a job might pay. To be sure, Market Salary is not 100% accurate, nor is it intended to be. But it is a powerful help when trying to determine where real high-road employment opportunities might exist within the mountain of job posting data.

As the chart below shows, there is a widening gap in the estimated pay percentiles when comparing jobs requiring less than a four-year degree to those requiring at least a four-year degree.

As expected, there is wide variation when looking at the regional and sector-specific levels. What we find repeatedly, however, is that a portion of manufacturing jobs offer pay rates comparable to or below other competing sectors. More troubling still is the fact that some manufacturing jobs fail to pay a family-sustaining wage for their location. Entry-level pay estimates (interpreted from 10th percentile and 25th percentile figures) for jobs requiring less than a four-year degree average out to $11 to $14 per hour (assuming a 2,080-hour work year). It bears repeating that these data are estimates based on Burning Glass Technologies’ software and not the actual advertises salaries. All the same, as a reflection of the job market for manufacturing jobs, these posting data make a strong case for a four-year degree and show that, at least for a substantial portion of manufacturing openings requiring less than a four-year degree, employers may find themselves competing with other sectors paying as much or more.

WDI has a long commitment to New York’s manufacturing workforce. We work hard to identify high-road employers that offer a living wage, a healthy work culture, and opportunities for positive worker outcomes. We partner with these employers to identify innovative, timely, and impactful workforce solutions that result in promotions, upskilling, job growth, retention, and placement. Finding ways to promote worker advancement is baked into our regional model and our organizational values.

New York’s manufacturing sector faces a variety of challenges year in and year out. Its employers see their share of ups and downs. The New York Fed’s Empire State Manufacturing Survey is a great tool to track many of those ups and downs. When it comes to finding ways to support the sector’s workforce, WDI always looks beyond the headlines in search of worker-centric approaches.